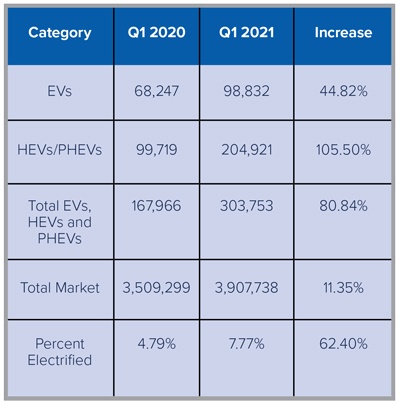

During the first quarter of 2021, the number of EV sales in the U.S. was greater than 300,000. More specifically, EV sales outperformed the overall market and increased 81% when compared against Q1 2020. The following table shows the exact numbers:

The largest growth was for hybrids and plug-in hybrids. The reason is obvious. Although an increasing number of people are buying EV technology to help counter high gas prices and reduce their carbon footprint, they don’t want to risk running out of fuel when traveling, even if traveling only consists of a short commute. Federal tax credits on some popular models has been phased out, though, and that has caused a corresponding decline in sales. The pandemic also caused a decline, but it wasn’t as big as many people feared when the economy first shut down in March 2020.

What is currently selling best? Consider EVs first. The main players are Tesla, Chevrolet and Ford. Tesla has the two top spots for 2021 (Model Y is No. 1 and Model S is No. 2), but No. 3 is the Chevrolet Bolt. Chevrolet sold almost 10,000 of them during the first quarter. No. 4, an all-new version of the Ford Mustang Mach-E, first went on sale in December 2020 and did better in Q1 2021 than Tesla’s Model S and Model X combined. Tesla had some additional bad news. The Model 3 was No. 1 in 2020, but year-over-year sales fell more than 50%.

What about hybrid sales (HEVs and PHEVs)? More than 60 different kinds are available in the U.S., but the main players are Toyota, Honda, Ford and Volvo.

Toyota is No. 1. It sold 124,449 hybrid vehicles in Q1 2021. The most popular one was the Toyota RAV4 Hybrid, which accounted for 32,263 of those sales. No. 2, at 26,044, was the Toyota Sienna minivan, which is now sold only as a hybrid. Almost one-fourth of all Toyotas being sold now are hybrids.

Honda is No. 2 after selling 22,000 hybrids in Q1 2021, and Ford is No. 3 after selling more than 18,000 hybrids. Of the vehicles they sold, 7,176 were F-Series pickups. Volvo is No. 4. It sold 2,800 hybrids in Q1 2021.

These numbers are small when compared against sales of traditional combustion engines, but a Pew Research Center survey found that even though only 7% of U.S. adults own an electric of vehicle of some kind, 39% said they were very likely or somewhat likely to think seriously about buying one the next time they buy. Almost 1.8 million U.S. EVs were registered in 2020, but that is more than three times as many as were registered in 2016.

Who is most likely to buy an EV of some kind?

- People who live in big cities and have garages or access to charging stations. In 2015, there were less than 32,000 charging stations in the U.S. That number had tripled by May 2021, and the International Energy Agency expects the U.S. to have between 800,000 and 1.7 million by the end of 2029. The place with the most charging stations is Washington, D.C. (237 stations). No. 2 is Vermont and No. 3 is California. However, the national average is one outlet for 2,570 vehicles.

- Those who live in Europe or China. Between 2016 and 2020, the compound annual growth is 60% in Europe, 36% in China and 17% in the U.S.

- Residents of states such as California, Washington, Oregon, Colorado, Arizona, Hawaii, Vermont and Massachusetts. In 2018, California had more EVs than any other state (12 per 1,000), with Hawaii in second place (6 per 1,000). Other states in 2018 that had between 1.0 and 1.9 registrations per 1,000 people were Nevada, Utah, Georgia, Maryland, New Hampshire, Connecticut, New Jersey, and the District of Columbia.

- Those who want to avoid the service shop. The engines are simpler, and so is the maintenance. This may eventually be a significant factor for dealers, who often benefit from their service departments, but not until more EVs are on the road. Even then, though, less service is not the same as no service.

- Car lovers who enjoy the combination of great driving performance and almost no emissions.

It’s clear that the automobile industry is moving toward full or partial EVs and away from gas-powered vehicles. This is especially true because of the current emphasis on providing the necessary infrastructure so owners can rely on being able to charge their cars the same way they currently rely on being able to buy gas.

Now is the time to begin building the infrastructure that will support EVs.