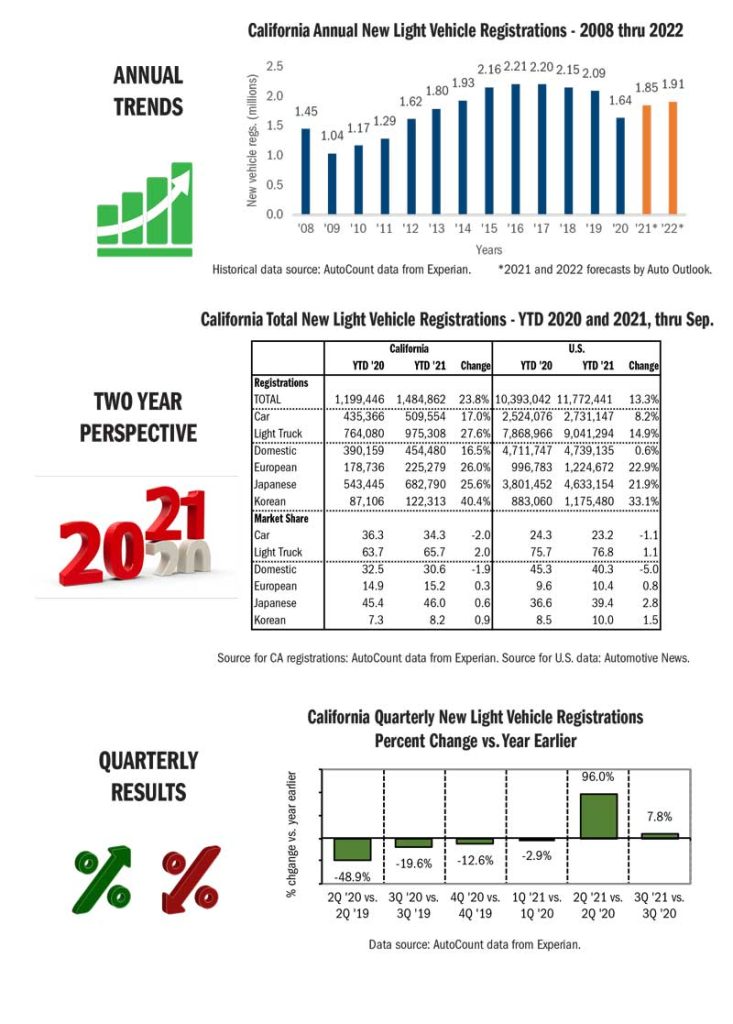

Tight Supplies Could Keep State New Vehicle Registrations Below 2 Million Units in 2022

Outlook For California New Vehicle Market

California new vehicle registrations are predicted to reach 1.85 million units for all of 2021, a 12.9 percent increase versus 2020. Fourth Quarter registrations this year are expected to decline by approximately 17 percent versus 4Q ‘20.

The market is predicted to increase slightly in 2022, with registrations improving to 1.91 million units, up 3.2 percent from 2021.

Typically, forecasts for California new vehicle registrations are a function of key factors related to demand, such as employment, household income, consumer sentiment, and interest rates. For perhaps the next 15 months, however, sales levels will likely be linked to how many vehicles can be produced.

Pinpointing production volume is a complex puzzle impacted by several interrelated pieces: the chip shortage, COVID induced labor cutbacks, tight supplies of other key components, and transportation logistics.

Due to this elevated uncertainty, an alternative forecasting approach was used to derive the above forecasts. The methodology translates expected levels for the U.S. seasonally adjusted annual rate of sales (SAAR) into new vehicle registrations in the state.

Although analyst predictions for U.S. new vehicle sales vary, the consensus outlook for 4Q ‘21 SAAR is roughly 13 million units. Based on historical trends, a Fourth Quarter SAAR of 13 million units is equivalent to 365,000 new vehicle registrations in California, down 17 percent from 4Q ‘20.

Early predictions for SAAR in 2022 are in the vicinity of 15.4 million units, which is equivalent to 1.91 million new vehicle registrations in the state.